Contents

In particular, traders like this strategy because it is less likely to be affected by adverse events, and it is easier to succeed in narrow spreads and moments of market volatility. Scalping may be the main or additional strategy (« umbrella » concept) when traders minimize costs where they can. Scalpers often use high leverage to place larger-sized trades because their strategy consists of achieving greater profits from small price changes. The key thing to remember when trading leveraged or margined financial products is that while leverage increases your total profits, it also works to magnify your potential losses. When it’s discussed online, scalping usually refers to the practice of making money by reselling something in limited supply.

- As a scalper, you have to be good at visualizing potential scenarios that could happen.

- Scalp traders who indulge in online stock trading are on the other side of the trader spectrum, where you have traders who hold onto promising stocks, often waiting months to see some profit.

- Ask price is the lowest price for which a seller will sell the security.

- Risk management– Rather than looking for one big trade, the way a trend trader might, the scalper looks for hundreds of small profits throughout the day.

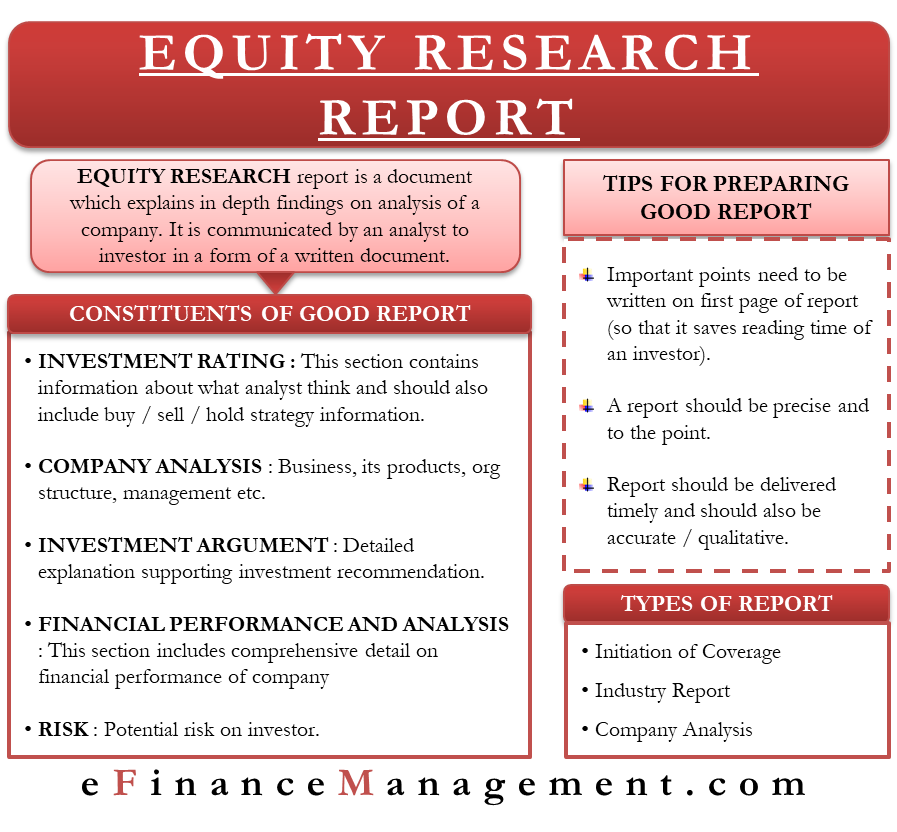

This allows traders to evaluate a company and manage risk for growing their wealth over time. To scalp trade, a trader enters a limit order to buy a specific number of stocks at a set price. The trade is automatically executed when the price falls to the limit order. If the stock’s price moves up one minute later, the trader closes the trade. If they’d bought 2,000 shares, and the stock’s price moved up $.04 from their purchase price, they would make $80.

What Are Some Scalping Trading Strategies?

Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. Scalping is based on an assumption that most stocks will complete the first stage of a movement. After that initial stage, some stocks cease to advance, while others continue advancing. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Emily Norris is the managing editor of Traders Reserve; she has 10+ years of experience in financial publishing and editing and is an expert on business, personal finance, and trading.

However, swing trading accompanies a more intermediate-term time frame, often a few days to a few weeks, focusing on acquiring fewer trades but with a larger profit target. A slower pace and a less stressful environment make swing trading more appropriate for novice and retail traders, while scalping is better suited to more seasoned traders. With most day trading strategies, trades can be held even for a couple of hours within the same trading day, with traders analyzing the market using both https://1investing.in/ fundamental and technical analysis methods. But with scalping, trades are held for a few seconds or a few minutes; and scalpers almost exclusively use technical analysis methods because of the short holding periods of their trades. Scalpers use day trading buying power of four to one margin to maximize profits with the most shares in the shortest amount of holding time. This requires focusing on the smaller time frame interval charts such as the one-minute and five-minute candlestick charts.

Reduced commissions are considered a must for scalpers that trade significant volume on a daily basis. With that in mind, there are no formal education requirements for one to become a scalper on their own. In fact, technically it’s something that just about anyone can do if they have the time and the means. Scalping is not for you especially also if you have a full-time job and trading is only a part-time job for you, then don’t try scalping. In fact, for most of you reading now, I think scalpers trading is not for you.

What Is A Scalper Screen?

Karl Bodmer’s 1844 aquatint Scalp Dance of the Minitarres depicts Siouan Hidatsa people in a scalp dance. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within repurchase agreement in india our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. Experience award-winning platforms with fast and secure execution.

You will have to learn the structure of Forex trading in general to understand what are spreads in Forex trading. The first thing is that all FX transactions are carried out using intermediaries. The profit of an online broker is the difference between bid-price and ask-price. So, when you are trying to understand what do spreads mean in Forex, here is the answer. Scalping in the Forex market is a form of real-time currency trading with short holding positions and a relatively small profit from each trade.

Scalper also refers to someone who buys up in-demand merchandise or event tickets to resell at a higher price. In addition, high-frequency trading requires a powerful computer, ultra-high-speed internet, complex algorithmic trading software, and servers often located near an exchange. For this reason, high-frequency trading is practiced by large financial institutions (e.g., hedge funds) rather than retail investors. Quebec resident Julien Lavallée was reported to use bots to rapidly purchase tickets to entertainment events across the world. For example, CBC writes that he automatically bought 310 tickets to three Adele concerts, and resold these for a whopping $52,000. Meanwhile, the EU has outlawed scalping bots with an April 2019 decision, after a Pan-European pressure group made up of musicians and event promoters called FEAT raised awareness of the issue.

Today, spreads are often a couple of cents apart, and trades are done in pennies. This is an issue because it may make it harder for the scalper to reap a profit. With this strategy, the trader aims to capitalize on the bid-ask spread by putting out a bid and making an offer for the same stock at the same time. This strategy is best employed with stocks that are not showing any real-time price changes. Spotting the trend andmomentumcomes in handy for a scalper who can even enter and exit briefly to repeat a pattern.

Scalping Strategies

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Her stint as a legal assistant at a law firm equipped her to track down legal, policy and financial information. Whenever the spread is made one party must pay it and some party will receive that money as profit. No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

In many states, the resale of tickets outside the location of an event is considered illegal. Also occasionally, predators will pose as ticket scalpers in order to lure people away from an event and rob or hurt them. One should never follow a scalper anywhere that takes one away from the public view. This is a dangerous practice that could get one hurt, especially if the fake scalper knows one is carrying a lot of cash to make a purchase. First off, maintaining such a large number of positions can be very time-consuming.

The trader works by using many signals to open trades when the charts point in a certain direction. Scalpers typically use the one- and five-minute charts when trading. They may also purchase market scanning software to support them in finding new trading opportunities. Most scalpers engage in high-volume trading and use online brokers that offer low spreads and low or no commission to keep their trading costs to a minimum. The tickets for popular events can sell out within minutes or even seconds. Scalpers will often buy as many tickets as they can and then upload them to popular ticket reselling markets or classified websites like Craigslist or Facebook Marketplace.

What Are Online Scalpers and What Do They Do?

To make a long story short, you will have to prepare for a quick entry into the market and a timely exit from it. This style of trading is suitable for active and purposeful professionals with large volumes, which allows them to get the maximum profit from each transaction. Meanwhile, traders avoid exotic currencies and those with little liquidity.

Once you are done with all the checks, go to the preferred trading platform, and start trading. Scalping screens work by vibrating or shaking the material that is being processed. The vibration or shaking motion causes the material to break into smaller pieces. The smaller pieces then fall through the openings in the scalping screen.

Is scalping profitable?

You may want to test the environment with virtual money with a Demo account. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums. This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal. The fraudsters are luring the general public to transfer them money by falsely committing attractive brokerage / investment schemes of share market and/or Mutual Funds and/or personal loan facilities.

They may also purchase intraday scanning software to find new opportunities. Most scalpers engage in high volume trading and use online brokers that offer competitive commissions to keep their trading costs to a minimum. A scalper enters a limit order (an order to buy/sell an asset at a specified price or better) to buy a specific number of shares at a predetermined price. The trade is automatically executed once the price falls to the limit order. So, if they bought 1,000 shares, and the price increased by $0.05, they made $50. For example, scalpers exit trades once they have achieved their profit target instead of waiting to see whether they can profit more.